|

|

|

|

|

|

|

|

|

|

|

|

| |

|

COVID19 TAX RELIEF -

IMPORTANT INSTRUCTIONS FOR MY CURRENT / FUTURE CLIENTS |

|

1. Go to IRS. GOV website

2. Press "GET CORONAVIRUS TAX RELIEF" button

3. Press "check your payment Status"

4. Press "get my payment"

5. Press "get my payment"

6. Then you will be instructed to an IRS authorized use

screen, Press OK

7. Once you are in the system it will prompt you to add

your social security number, street address and zip

code.

|

8.It will also ask you

for your 2019 or 2018 Adjusted Gross Income and

Refund/owed amount. If you do not know these numbers,

please TEXT me. I will provide them for you .

Once you pass these

pages, then you will be instructed to add your bank

routing number and account number. Please be careful,

because there is no change screen once you press enter.

Should you have any questions, kindly text me, Thank

you, Paul Gastaldo VTS Tax

|

|

|

|

LATEST

UPDATE

NEW TAX SEASON HOURS

January 24, 2022 - April 15, 2022

9:30am -

6:30pm

Monday - Friday

10:00am - 4:00pm

Saturday

(By appointment only)

Sunday

Please call, text or email during open hours.

If you contact me during closed hours,

I will get back to you within 24-48 hours.

---------------------------------------------------------------------------------------------------------------------------

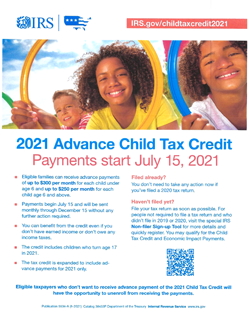

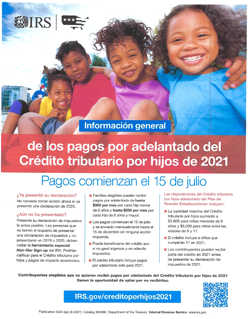

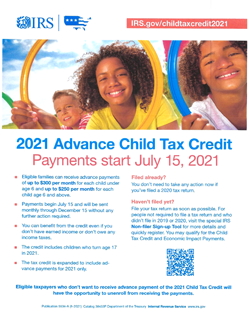

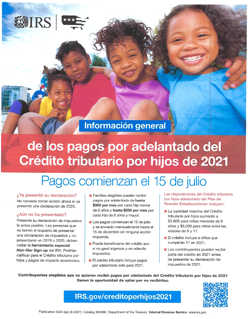

NEW ADVANCE CHILD TAX CREDIT

Please read below for

more information

(ENGLISH)

|

(SPANISH)

|

If you have

any questions,

please text or email me after July 15th, 2021

---------------------------------------------------------------------------------------------------------------------------

New Exclusion of up to $10,200

of

Unemployment Compensation

If your modified adjusted gross

income (AGI) is less than

$150,000,

the American Rescue Plan enacted on

March 11, 2021 excludes from

income up to $10,200 of unemployment compensation

paid in 2020, which

means you don't have to pay tax on

unemployment

compensation of up to $10,200.

---------------------------------------------------------------------------------------------------------------------------

Thank you for your

continued business.

Phone: 917-864-2486

Email:

info@vtstax.com

Fax:

347-273-2023

(Kindly follow the COVID-19 protocol

and enter with masks on)

|

|

|

|

ACCEPTED PAYMENT METHODS

Cash | Credit Card | Payment Mobile Apps

(Federal

Returns starting at $150.00)

Please select from the below mobile payment options

Type "Paul Gastaldo" under Search

|

|

|

|

ABOUT

|

Paul Gastaldo

VTS Tax and Business Services

|

VTS Tax offers professional tax preparation services to individuals

and businesses in Staten Island and the New York City metropolitan area

for over 30 years.

Individuals benefit from tax preparation and planning services

as well as Audit Defense and free review of last years taxes.

Unlike

larger firms that provide prepackaged solutions

for individuals

and

businesses.

VTS Tax provides customized services to the precise

needs of our clients throughout the year. We provide each of our

clients with the highly personalized service they expect and deserve

from their New York Public Accountant.

At VTS Tax all new clients work with

our tax professionals to

compile a confidential financial profile

based on income, expenses, needs and goals. In addition to

providing

tax advisement and preparation services for individuals and

businesses VTS Tax also offers additional services such as Small

Business Tax Return preparation, Corporate (S) Tax Return

preparation,

Tax Identification Number Application preparation and more. |

|

|

|

|

|

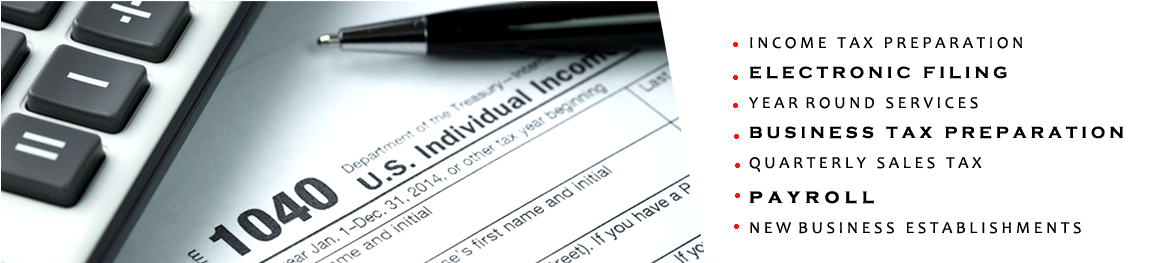

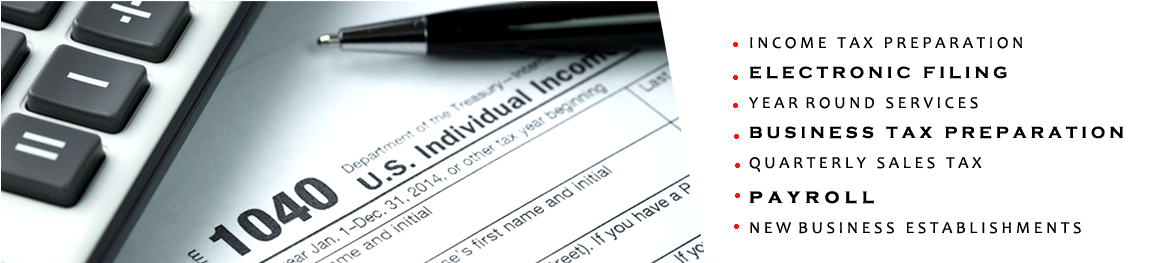

SERVICES

|

Individual Income Tax

Preparation

Small Business Tax Return Preparation

Partnership Tax Return Preparation

Corporate (S) Tax Return Preparation

Tax Identification Number Application Preparation

Non-Resident Tax Return Preparation

State Tax Return Preparation (all applicable U.S. states)

and more...

|

|

|

|

|

RESOURCES

"Tax Cuts and Jobs Act: What the Tax Reform Bill Means for You"

(The IRS has made some adjustments since the original law was passed)

More Information

>

|

|

|

|

DOCUMENTATION REQUIRED

DURING YOUR APPOINTMENT

PERSONAL INFORMATION

Your Social Security number and/or tax ID number

Your spouse's full name and Social Security number

and/or tax ID

number

Photo ID, such as Passport and/or state issued ID,

such as a Drivers

License, Permit or Non-Drivers ID.

DEPENDENTS

Date of Birth and Social Security and/or Tax ID number

Copy of Birth Certificate

Income of Dependents (children and/or adults)

EDUCATION PAYMENTS

Form 1098-T from Educational Institution

Receipts that itemize qualified educational expenses

Record of any scholarship you received

Form 1098-E, student loan interest

EMPLOYEE INFORMATION

Form (s) W-2

SELF EMPLOYMENT INFORMATION

Form 1099-Misc., schedule K-1 and/or Income records

to verify

amounts nor reported on 1099-Misc and/or 1099-S

Record of all expenses, check register and/or

credit card statement

and receipts

Business Use asset information (cost, date, placed in service)

for

depreciation

|

|

|

|

LOCATION |

|

130 PORT RICHMOND AVENUE

STATEN ISLAND, NEW YORK 10302

BUSES

From St. George (The Ferry) 96 Bus

and 46 Bus

From Brooklyn S53 Bus from Bay

Ridge

(Office is at Stop

Castleton & Port Richmond Avenue Bus Stop)

|

|

|

|

| |

| |

|

Copyright 2021 - VTS Business and Tax

Services |